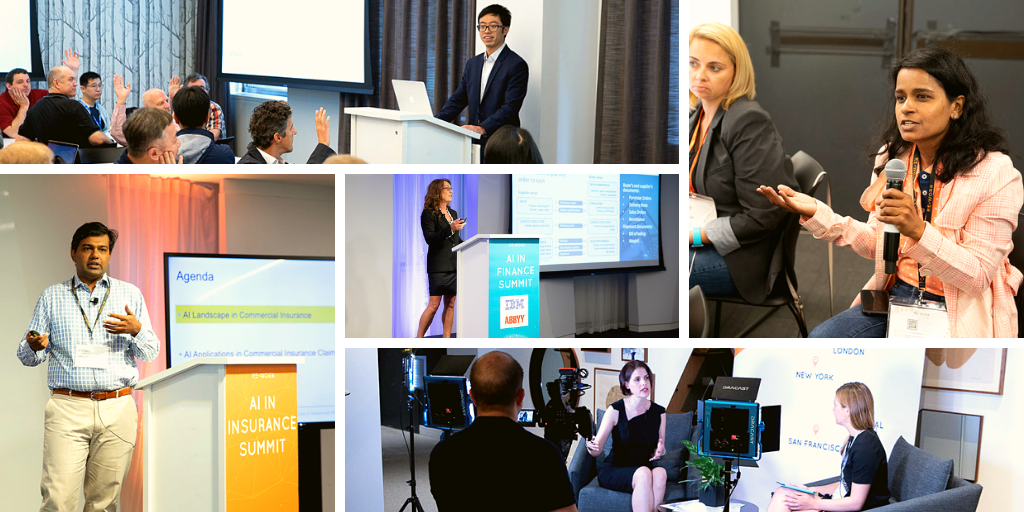

Yesterday at the AI in Finance Summit and the AI in Insurance Summit in New York we heard breakthroughs from Barclays US, MasterCard, Haven Life and JP Morgan who explored insights into the optimization of processes and procedures in both sectors, and learned that cross-collaboration is key - "The best place to look for the lead in change is outside this industry." Baiju Devani from AVIVA went on to explain that “the algorithmic revolution is happening everywhere. We need to be thinking algorithms first, not just AI first.”

Wrapping up the evening over networking drinks, it was great to hear what attendees learned and what they’d enjoyed about the summit so far:

“We go to a lot of events but this one is special. Usually there are only one or two questions after each talk but the Q&A’s here don't stop! The conference is great in that it is so interactive and everyone is really engaged.” - Noorjit Sidhu, Plug and Play Ventures

“As the insurance talks are cross sector I was so surprised today that all of the talks have been applicable to me! There has been so much to learn. I especially enjoyed David from Trupanions talk.” - Courtney McCormac, New York Life

“I want to work in AI and Finance because finance is important for both everyone's daily life and for the whole economy, and AI innovations will help us solve the financial problems in a faster and more efficient way. One thing that I am particularly interested in is how AI can utilize natural language processing to interpret all kinds of information in a quantitate way.” - Luwei Yang, NYU

“You thought AI was cool, this is AI IN INSURANCE, just wait!” - Newcombe Clark, AIG

“You guys are doing a fantastic job. The kick off this morning in insurance was fabulous and my favourite presentation was from State Farm on distracted driving. I'm a CTO so some of the super technical presentations were a bit beyond me, but when they were related to business problems it became way more relatable. Explainability came up a lot today, and there was a talk this afternoon relating directly to that which was one of the most insightful.” - Laurie Winters, Publicis Sapient

“It’s really good that it’s a smaller conference because it stops you from getting lost in the crowd. We have had valuable discussions and leads which we have the next steps for.” - Rachel Claire, Introhive

Back for a second day of AI and machine learning, attendees continued yesterday's conversations over coffee and breakfast before settling into the morning sessions. As well as showcasing leading businesses and academics, at each RE•WORK Summit we showcase the most cutting-edge up and coming startups in the field. Kicking off the startup session at the AI in Finance Summit, Adam Stewart from Introhive shared his work on Building Relationship Capital and Grow the Bottom Line with AI. He explained that “relationships are important in professional services and financial services. People underestimate how important relationships are. What our platform does is connect into your communication platform. Automate data in, get intelligence out" He explained that one of the fundamental flaws of CRMs is a lack of good data. The reason there is not good data is because people don't spend the time putting the data in. You can't then use this for insights. Introhive automates getting this information into your CRM of choice to solve this problem, removing the requirement to do data entry.

Over on the AI in Insurance track, Tzvi Aviv from AgriLogicAI spoke about how they are working to help farmers and crop insurance companies mitigate weather and climate change risks by applying DL and ML to satellite images and historical farm data. He looked at the long term projections and explained that when looking at the risk of global warming in the US, “not all the states are equal.” Continuing the theme of the environment and agriculture, George Lee from Travelers spoke about how they’re using deep learning to help reduce wildfire risk. “We work closely with the insurance business for home safety about how to make the right choices for your house. We have an innovation jam which is an annual global event, like a hackathon where 100’s of people compete. This drives innovation.” He said that the different types of computer vision they use are classification, localisation, object detection, and semantic segmentation.”

As well as the emerging startups, we had several VCs at the summit sharing their insights in gaining investment, adopting AI, and succeeding in the FinTech and InsurTech space. Noorjit Sidhu from Plug and Play Ventures explained that they spend a lot of time encouraging people to think a lot about bias. Another issue is consumer trust. Also on the panel were Deborah Barta from Mastercard, Devin Devrai from American Family Ventures, Josh Cohen from Mutual Strategic Ventures and Tyler Lange from Plug and Play Tech Center. Deborah shared her experience and said that some of the mistakes startups often make in the early stages are being too technology driven. “Sometimes these startups have amazing ways to use AI, but the don’t quite have the problem they’re trying to solve pinned down. This can lead to issues further on, so it’s important to be really clear about what you’re trying to achieve.”

What else did we learn this morning?

- Galaxy.AI have seen a reduction in claims fraud in their car insurance policies, and Jas Maggu explained that “The first step is the detection of fraud and then detecting this more accurately. This is what we focus on.” She went on to explain that they have built a DL engine for analysis of images to give real time automated damage assessment for the property and casualty insurance industry.

- ABBYY’s Vice President of Global Customer Enablement, Paula Sanders spoke about how they’re using machine learning and cognitive automation for documents. “Everyone wants their documents automatically processed, but people don’t want to put in the work. We use deep neural networks to extract the metadata in documents. We use 2 sets that we train off of, convolutional and LSTM. Our DNN imitates human understanding and it helps us get a better understanding. We’ve trained on several types of documents and we’re expanding into more.”

- David Jaw, Director of Data Science at Trupanion shared his work in claims in the pet health insurance space and explained how they now automate 30% of its electronically submitted claims using ML models. “Trupanion is an organization with an existing workflow, doing the same thing for years. Therefore there are a lot of frictional costs associated with trying to integrate AI and data science at Trupanion.”

- In a joint presentation, Arturo Gonzalez and Carlos Ignacio Patino-Florez from Bancolombia spoke about coincident indicators for the Colombian Economy. “Thanks to its market share, ample client base and widespread presence (37% market share), Bancolombias transaction data properly reflects overall economic activity.”

In the lunch break, CORE hosted a lunch & learn session, several interviews were filmed in the networking area, and attendees enjoyed a hot three-course-lunch. Exhibitors exchanged tips and tricks of applying AI in Finance and Insurance, and we filmed several demos at their booths.

Both AI and Finance & Insurance are vastly male dominated fields. At every RE•WORK Summit, we strive to represent as diverse an audience of speakers and attendees as possible, and we recorded several episodes of our Women in AI Podcast across the two days. Wrapping up the day on the insurance track were several fantastic women sharing their cutting edge work in the space. First up was Natalie Jakomis from GoCompare who spoke about ‘Developing Innovative Data Science Solutions to Increase Customer Retention’ and explained that they’re creating a ‘personalized data-driven experience called SaveStack which allows smoother payments and automation with better data and better recommendations.’ They have started partnering with banks and are building applications that sit on top of the banking app. “It’s a flexible platform that’s allowing us to innovate at speed.” Following Natalie, Saira Kazmi from Connecticut College spoke about the importance of meta-data in the machine learning lifecycle. “I’ve seen this in multiple presentations, but it’s important - we need to understand the business problem, then we need the data process understanding. Before this you have to prepare your data which can take months and months. I think the number people share is 80:20 - you spend 80% of the time cleaning and getting data right, then only 20% modelling.” Up next was Courtney McCormac who expressed her excitement for Machine Learning and Data Science in Insurance, but also her concern: “I've started to get nervous. not because I think AI is going to take my job, but because I don't think there are enough people out there who know how to get AI into real life. I think FinTech and InsurTech is definitely in this place, so I have a nervousness about this knowledge gap, and I'm now trying to push it forwards.”

Running alongside these presentations in the AI in Finance room, Kishore Karra from J.P. Morgan spoke about the role of machine learning in anti-money laundering. “ML to the rescue! Using Machine learning reduces false positives, provides intelligent segmentation and captive risk rating,” he explained. His presentation also drew on the limitations of machine learning, including the tendency to overfit data availability in the key process and a lack of transparency still. Following on from Kishore was Ron Wu from Morgan Stanley who talked us through their work building their NLP pipeline. Their NLP engine is made up of a tokenizer, abbreviation handler, spell checker, parser and lemmatizer. He explained that chatbots are ubiquitous in customer service, and despite the research and development in AI, recent data shows that the majority of humans still prefer to chat to a human rather than a machine. This led to him explaining the next steps in their NLP pipeline, which is the feature extractor, applying machine learning techniques.

As the day drew to a close, both summits hosted closing panel discussions. On the AI in Finance Summit, Kamalesh Rao from Societe Generale, Marsal Gavalda from Square, Valentino Zocca from Citi and Zachary Glassman from UBS spoke about overcoming obstacles to capturing ROI in AI and Machine Learning.

- Valentino: AI and machine learning is the pinnacle of a long journey, the beginning of this journey is getting your data correct.

- Zachary: What are the obstacles I’m going to face when trying to implement AI? It is a journey to producing AI that can produce profit and cost saving. What is needed is patience.

- Marsal: Any forward-looking company should have an AI strategy. You have to treat data as a first class citizen.

Speaking about the opportunities and challenges for the future of AI in Insurance on the closing panel were Vishnu Narayanasamy, Liberty Mutual; David Jaw, Trupanion & Kaushik Pamulparthy, Northwestern Mutual, and the moderator, Bernard Goyder, The Insurance Insider:

- Kaushik: Success for us is about qualifying what a great experience is, and providing that digitally.

- David: The first successful project we had was automating claims. We first must add value, and then we can build up trust to have the freedom to work on things we think will add value in the future. Now that our automation has been proven, we have the trust to now work on long-term goals. We have a lot of data, and we can learn a lot from this data. I want to get to the point where everything we should know, we do know. I want to know how much premium we should expect to collect.

- Vishnu: We're in the world of commercial insurance. We have a history of predictive analytics. The commercial world is very complicated, the risk profile and solutions is challenging. We're working out the best solutions to bring forward that add value.